Advancements in directed energy (DE) technology are critical to the support of the U.S National Defense strategy. As the Department of Defense looks to replace its present anti-missile weapons systems with laser-based systems, the need for directed energy technologies continues to grow.

Directed Energy Market Overview

While the directed energy space includes technologies such as microwaves, lasers have consumed the bulk of the attention and spending. Over the last two years, the U.S. military has doubled its spending on directed energy weapons and the market is expected to continue growth at a 23.26% CAGR through 2025.

| 2017 | 2018 | 2019 | |

| US Army | $78M | $192M | $148M |

| US Navy | $123M | $173M | $259M |

| US Air Force | $166M | $248M | $235M |

| Missile Defense Agency | $35M | $74M | $224M |

| Joint Non-Lethal Weapons | $47M | $44M | $47M |

| DE Joint Transition Office | $56M | $57M | $57M |

| OSD (+DARPA & SOCOM) | $30M | $33M | $122M |

| Total | $535M | $821M | $1.092B |

Figure 1: Increase from $535M to $1.092B in two years.

The past several years of government funding efforts for directed energy have been devoted to improving the following system parameters:

- Increasing laser power on target

- Improving system efficiency

- Reducing size and weight of the laser system to expand available deployable platforms

- Reducing cost

Opportunities and Challenges for Directed Energy Lasers

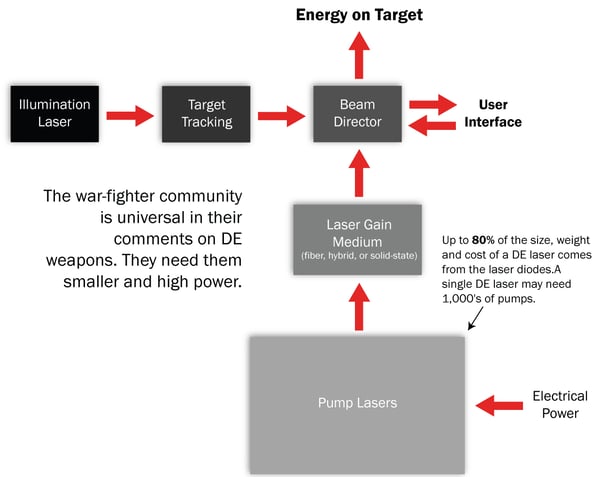

All directed energy lasers, whether they utilize fiber, solid-state or hybrid laser technologies, have one thing in common — they all use laser diodes as the primary laser component. Laser diodes are used to optically pump the laser gain medium when a command decision is made to fire a weapon. As shown in Figure 2, up to 80% of the size, weight and cost of a DE laser comes from the laser diodes. Any improvement in a DE laser weapon must first start by optimizing the semiconductor laser diode.

Figure 2

The forecasted market growth supports the laser diodes required for each DE laser architectures:

Fiber Lasers

Defense application: Man-portable Counter-Unmanned Aircraft Systems

Opportunities: Simple, compact and reliable, with high beam quality, fiber lasers offer advantages for directed energy. Lower powered systems are already in volume production for industrial applications, so opportunities exist to redesign these systems for military applications.

Challenges: Thermal management (fluid cooling), power scalability and portability

Diode Pumped Solid State Laser (DPSSL)

Defense applications: Aerospace, lidar, satellites

Opportunities: Build a unique system that is lightweight and performs efficiently and reliably in space.

Challenges: High cost and beam quality power scaling

Diode-Pumped Alkali Laser (DPAL)

Defense applications: Airborne, UAV, space

Opportunities: These systems are highly efficient and can achieve scalable megawatt power levels at size and weight targets compatible with airborne platforms.

Challenges: High cost and military hardened

Illuminators

Defense applications: All directed energy applications

Opportunities: Active target illumination. Direct diode technology offers very high electrical efficiency in a very low weight and sized package.

Challenges: Eye-safety and beam quality

The 2020 Department of Defense budget emphasizes the innovation of existing technologies, particularly high-power lasers, over complex space applications for the distant future. Therefore, power, weight, system integration and ease of use by soldiers in the field are critical factors in achieving viability and market growth.

Continued innovation in the directed energy space will only advance our military capabilities and provide more powerful weaponry. Investment in improving laser diode technology is essential to meeting key metrics for laser weapon systems.